Global Gluten Free Alcohol Market

Market Size in USD Billion

CAGR :

%

USD

10.84 Billion

USD

24.36 Billion

2025

2033

USD

10.84 Billion

USD

24.36 Billion

2025

2033

| 2026 –2033 | |

| USD 10.84 Billion | |

| USD 24.36 Billion | |

|

|

|

|

What is the Global Gluten-free Alcohol Market Size and Growth Rate?

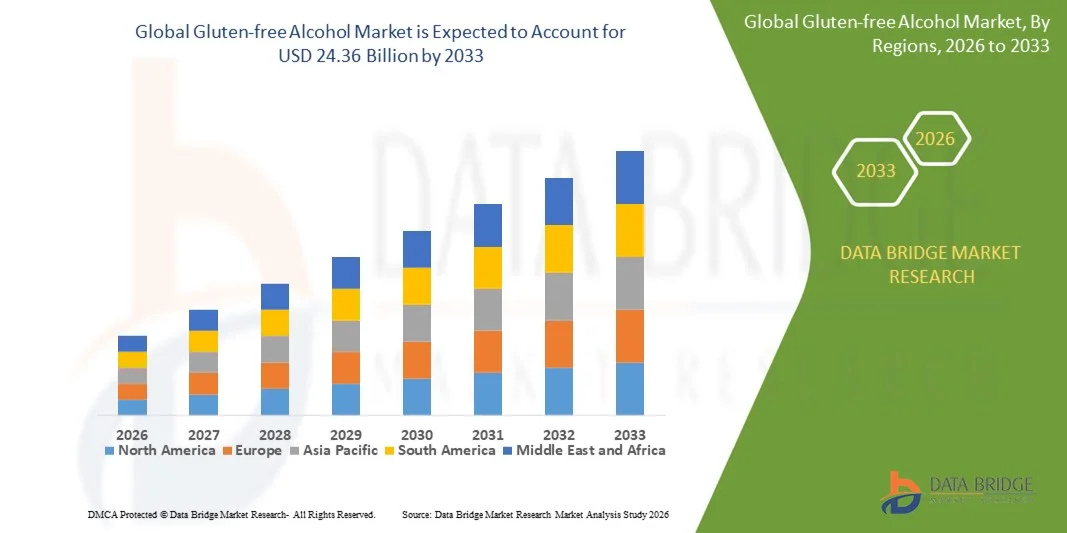

- The global gluten-free alcohol market size was valued at USD 10.84 billion in 2025 and is expected to reach USD 24.36 billion by 2033, at a CAGR of 10.65% during the forecast period

- The rise in the number of celiac disease incidences across the globe acts as one of the major factors driving the growth of gluten-free alcohol market

- The increase in adoption of special dietary lifestyles and free-from foods, and high adoption of gluten-product prevention of health disorders, such as heart diseases, diabetes, obesity, metabolic syndrome, stroke, and chronic pulmonary disease accelerate the market growth.

What are the Major Takeaways of Gluten-free Alcohol Market?

- The rise in prevalence of irritable bowel syndrome (IBS), and rise in availability of gluten-free products in organized retail stores leading to increased sales, and health benefits further influence the market

- In addition, surge in food spending, media influence on consumer awareness, high use in range of food, rise in health consciousness among consumers and rise in trend of dieting positively affect the gluten-free alcohol market

- Furthermore, adoption of microencapsulation technology to improve the shelf-life of gluten-free products extends profitable opportunities to the market players

- North America dominated the gluten-free alcohol market with an estimated 36.8% revenue share in 2025, driven by high consumer awareness of celiac disease, gluten intolerance, and clean-label preferences across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.36% from 2026 to 2033, driven by rapid urbanization, expanding middle-class population, and growing awareness of gluten intolerance and specialty alcoholic beverages across Australia, Japan, China, and India

- The Gluten-Free Beer segment dominated the market with an estimated 34.6% share in 2025, as it remains the most widely consumed gluten-free alcoholic beverage globally

Report Scope and Gluten-free Alcohol Market Segmentation

|

Attributes |

Gluten-free Alcohol Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Gluten-free Alcohol Market?

Rising Consumer Preference for Clean-Label, Functional, and Premium Gluten-free Alcoholic Beverages

- The gluten-free alcohol market is witnessing strong growth driven by increasing consumer awareness regarding gluten intolerance, celiac disease, and digestive health concerns

- Manufacturers are introducing craft gluten-free beers, spirits, and ready-to-drink (RTD) beverages made from sorghum, rice, corn, millet, and agave as alternative grains

- Growing demand for clean-label, non-GMO, organic, and preservative-free alcoholic beverages is reshaping product innovation strategies

- For instance, companies such as Anheuser-Busch, Bard’s Brewing, Glutenberg, and Ghostfish Brewing have expanded their gluten-free portfolios to cater to health-conscious consumers

- Increasing popularity of premium craft beverages and low-carb alcoholic drinks is accelerating product diversification across retail and on-trade channels

- As health-conscious drinking trends continue to rise globally, gluten-free alcohol will remain a key innovation segment within the broader alcoholic beverages industry

What are the Key Drivers of Gluten-free Alcohol Market?

- Rising prevalence of celiac disease, gluten sensitivity, and digestive health disorders is boosting demand for certified gluten-free alcoholic beverages

- For instance, in 2025, several global breweries and distilleries expanded certified gluten-free production lines to meet rising regulatory and consumer standards

- Growing adoption of healthier lifestyles, low-carb diets, and mindful drinking habits across the U.S., Europe, and Asia-Pacific supports market growth

- Expansion of e-commerce platforms, specialty liquor stores, and premium supermarkets improves product accessibility and consumer awareness

- Increasing innovation in fermentation technologies and alternative grain processing enhances taste profiles and product quality

- Supported by rising disposable income, premiumization trends, and expanding craft alcohol culture, the Gluten-free Alcohol market is expected to witness sustained long-term growth

Which Factor is Challenging the Growth of the Gluten-free Alcohol Market?

- Higher production costs associated with certified gluten-free ingredients, dedicated manufacturing facilities, and quality testing increase product pricing

- For instance, during 2024–2025, fluctuations in raw material prices such as sorghum and specialty grains impacted production margins for craft breweries

- Limited consumer awareness in developing regions regarding gluten-free certifications and labeling standards restricts widespread adoption

- Taste perception challenges and limited flavor variety compared to traditional barley-based beverages may influence repeat purchases

- Stringent regulatory standards and certification requirements across different countries increase compliance complexity for manufacturers

- To overcome these challenges, companies are investing in advanced brewing technologies, cost optimization strategies, wider distribution networks, and consumer education initiatives to strengthen global adoption of gluten-free alcohol beverages

How is the Gluten-free Alcohol Market Segmented?

The market is segmented on the basis of type and source.

- By Type

On the basis of type, the gluten-free alcohol market is segmented into Gluten-Free Beer, Gluten-Free Hard Cider, Gluten-Free Wine, Gluten-Free Wine Coolers, Gluten-Free Spirits, Gluten-Free Gin, Gluten-Free Rum, Gluten-Free Sake, Gluten-Free Tequila, Gluten-Free Vodka, Gluten-Free Whiskey, and Others. The Gluten-Free Beer segment dominated the market with an estimated 34.6% share in 2025, as it remains the most widely consumed gluten-free alcoholic beverage globally. Strong consumer preference for craft beer alternatives, increasing availability in supermarkets and bars, and rising awareness of gluten intolerance have supported its leadership position. Breweries are investing in sorghum- and rice-based fermentation technologies to improve flavor, texture, and mouthfeel, making gluten-free beer more comparable to traditional barley-based products.

The Gluten-Free Spirits segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for premium vodka, gin, tequila, and whiskey made from corn, potatoes, and agave. Increasing cocktail culture, premiumization trends, and expansion of gluten-free certifications across global distilleries are accelerating growth in this segment.

- By Source

On the basis of source, the gluten-free alcohol market is segmented into Buckwheat, Sorghum, Rice, Corn, Fruits, Potatoes, Sugar Cane, Agave Cactus, and Others. The Sorghum segment dominated the market with an estimated 28.9% share in 2025, primarily due to its widespread use in gluten-free beer production. Sorghum offers favorable fermentation properties, neutral taste characteristics, and cost-effectiveness, making it a preferred grain alternative among craft and commercial breweries. Its high starch content and compatibility with traditional brewing processes further enhance production efficiency and scalability.

The Agave Cactus segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by increasing global demand for premium gluten-free tequila and agave-based spirits. Rising consumer inclination toward clean-label, plant-based alcoholic beverages and strong export growth from tequila-producing regions are fueling segment expansion. Continuous innovation in alternative grain and plant-based alcohol production is expected to diversify raw material sourcing in the coming years.

Which Region Holds the Largest Share of the Gluten-free Alcohol Market?

- North America dominated the gluten-free alcohol market with an estimated 36.8% revenue share in 2025, driven by high consumer awareness of celiac disease, gluten intolerance, and clean-label preferences across the U.S. and Canada. Strong demand for gluten-free beer, spirits, and hard ciders, along with widespread product availability across supermarkets, specialty liquor stores, and e-commerce platforms, continues to fuel regional growth

- Leading beverage manufacturers and craft breweries in North America are expanding certified gluten-free portfolios, introducing sorghum-based beers, corn- and potato-based vodkas, and agave-based premium spirits to meet evolving consumer preferences. Continuous innovation in brewing techniques and premiumization trends further strengthen regional leadership

- High disposable income, strong retail distribution networks, and increasing preference for health-conscious alcoholic beverages reinforce long-term market expansion across the region

U.S. Gluten-free Alcohol Market Insight

The U.S. is the largest contributor in North America, supported by rising demand for specialty craft beverages and strong growth in gluten-free beer and spirits consumption. Expanding awareness of digestive health, clean-label ingredients, and allergen-free certifications is accelerating product adoption. The presence of major breweries, distilleries, and innovative startups launching certified gluten-free alcoholic beverages further drives market growth. Strong on-trade and off-trade distribution channels, coupled with premiumization and cocktail culture trends, continue to strengthen the U.S. market position.

Canada Gluten-free Alcohol Market Insight

Canada contributes significantly to regional growth, driven by increasing consumer preference for natural and allergen-free beverages. Growing demand for gluten-free craft beer and locally produced spirits, along with supportive labeling regulations, enhances product visibility. Expansion of specialty beverage aisles in retail chains and rising popularity of health-focused lifestyles further support market penetration across the country.

Asia-Pacific Gluten-free Alcohol Market

Asia-Pacific is projected to register the fastest CAGR of 8.36% from 2026 to 2033, driven by rapid urbanization, expanding middle-class population, and growing awareness of gluten intolerance and specialty alcoholic beverages across Australia, Japan, China, and India. Increasing adoption of premium imported spirits, rising cocktail culture, and expansion of modern retail formats are accelerating demand. Growth in tourism, hospitality sectors, and international brand penetration is further strengthening regional prospects. Rising experimentation with rice-based beers, fruit wines, and gluten-free craft innovations continues to expand product diversity across the region.

China Gluten-free Alcohol Market Insight

China is witnessing steady growth due to rising premium alcohol consumption and expanding urban retail infrastructure. Increasing demand for imported gluten-free spirits and innovative fruit-based alcoholic beverages is supporting market expansion.

Japan Gluten-free Alcohol Market Insight

Japan shows growing interest in specialty and health-focused beverages, supported by strong demand for rice-based alcoholic drinks and premium imported spirits. Rising awareness of dietary sensitivities supports steady adoption.

India Gluten-free Alcohol Market Insight

India is emerging as a promising growth hub, driven by expanding urban consumer base, increasing premium alcohol consumption, and growing health awareness among millennials. Rising presence of international brands strengthens adoption.

South Korea Gluten-free Alcohol Market Insight

South Korea contributes significantly due to strong premium spirits demand and evolving consumer preferences toward clean-label and specialty alcoholic beverages. Expanding modern retail channels support sustained market growth.

Which are the Top Companies in Gluten-free Alcohol Market?

The gluten-free alcohol industry is primarily led by well-established companies, including:

- DSM (Netherlands)

- Doehler (Germany)

- TITO’S HANDMADE VODKA (U.S.)

- The Hendrick's Gin Distillery Ltd (U.K.)

- BOMBAY SAPPHIRE (U.K.)

- Captain Morgan (U.S.)

- ReserveBar (U.S.)

- Don Julio (Mexico)

- Cabo Wabo (U.S.)

- BeerAdvocate (U.S.)

- Ghostfish Brewing Company (U.S.)

- Glutenberg (Canada)

- Gluten Free Beers (U.S.)

- Anheuser-Busch Companies, LLC (U.S.)

- Bard’s Brewing, LLC (U.S.)

- Brewery Rickoli (U.S.)

- BURNING BROTHERS BREWING, LLC (U.S.)

- COORS BREWING COMPANY (U.S.)

- Epic Brewing Company (U.S.)

What are the Recent Developments in Global Gluten-free Alcohol Market?

- In October 2025, Plenish launched the U.K.’s first zero-sugar oat drink, free from oils and additives, expanding its plant-based portfolio with Plenish Zero Sugar Oat M*lk made from just four natural ingredients—water, gluten-free organic oats, plant-based calcium, and salt—delivering a creamy taste without converting oats into natural sugars, exclusively available at Waitrose and online, marking a significant step toward clean-label and reduced-sugar dairy alternatives

- In September 2025, Central Standard Craft Distillery introduced Delta Dawn, a new range of THC-infused non-alcoholic beverages available in flavors such as Door County Cherry Lemonade and Fruit Punch, with each 12 oz can containing 10mg of THC while remaining alcohol-free and gluten-free, offering consumers a refreshing and innovative alternative to traditional spirits, thereby strengthening the growing functional beverage segment

- In August 2025, DioniLife unveiled two new non-alcoholic spirits, La Borosa, an agave-based tequila-style beverage, and Pavari 17, a Mediterranean-inspired bittersweet aperitivo, with La Borosa crafted from hand-harvested Blue Agave and oak-aged to replicate authentic tequila flavors without alcohol or sugar, reinforcing the premium non-alcoholic spirits movement

- In January 2025, Kiitos Brewing made history by launching the nation’s first 100% Fonio beer, brewed entirely from the ancient drought-resistant West African grain fonio, delivering tropical flavor notes of lychee and white grape with a near-translucent appearance, highlighting sustainable brewing innovation and diversification in gluten-free beer offerings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gluten Free Alcohol Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gluten Free Alcohol Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gluten Free Alcohol Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.